I wrote about how platforms are glass box organisations, given their network effects. But there are a lot of black boxes out there. In the digital platform space, there are a lot of firms that operate as black boxes. The glass box metaphor was heavily drawn on the internal culture of the firm, that is, what the employees of the firms do. This post is about what the employees don’t do.

Before I elaborate, let me highlight the work of one of my doctoral students, Sandeep Lakshmipathy. He elucidates four primary value creation opportunities of multi-sided platforms: Discovery, matching, transaction, and evaluation. In short, discovery platforms help reduce the search costs for the sides of the platform (think Craigslist), matching platforms use filters and algorithms to ensure that the preferences of both sides are catered to while delivering a match (think Tinder), transaction platforms reduce the frictions and transaction costs in interacting with the other sides of the platform (think MasterCard), and evaluation platform enable ratings/ reviews/ recommendations/ feedback of the service (think Yelp). Sure, some platforms provide multiple value, like Uber provides discovery, transaction, and evaluation; whereas Airbnb provides all four.

Our focus today is just matching platforms, and how they create more and more opaque black boxes.

Matching platforms

In one of our conversations about the difference between discovery and matching platforms, Sandeep quipped about the difference between choosing a tomato sauce on an e-commerce platform and choosing a partner on Tinder. While it is sufficient for me to like the tomato sauce, it is not important for the tomato sauce to like me! Unlike this, in a matching platform like Tinder, it is imperative for both sides to have liked each other. Here is where the algorithms kick in. Magic! Matching algorithms.

Matching algorithms are technically taught in graph theory. Graph theorists discuss two types of matching – common vertex matching and bipartite matching. Common vertex matching is used to match, for instance, people with similar interests, like students in a class interested in a specific project. On the other hand, bipartite matching is used to match two subsets with each other, like buyers and sellers in an e-commerce platform. There are various algorithms used by graph theorists, including Hungarian maximum matching algorithm, Edmond’s matching algorithm, and the Hopcroft-Karp algorithm. The specificity of the algorithms notwithstanding, each of these algorithms work on the basis of three things – the specific preferences as limiting criteria, the minimum matches to be returned, and the maximum matches possible.

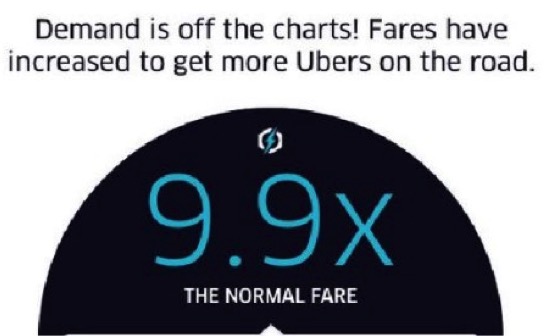

Imagine when you search for books to read on a peer-to-peer book-reading platform, and based on your preferences, you get exactly one recommendation. Just not sufficient enough choice, right? On the other hand, irrespective of the filters you add, if the recommendations do not change (the same titles keep appearing) and you get a recommendation of 5632 books, you feel overwhelmed. Both sides of the matching algorithms, there is a problem – of underwhelming and overwhelming choice. It is exactly to solve these problems that matching algorithms collect enough data from the users.

Some algorithms start with providing random matches, and based on the expressed user preferences, gradually mature their matching. Some others start at one extreme – like the shopping assistant in a mom-n-pop retail store. Once she’s estimated your broad preferences and budgets, she is most likely to start with showing you options very close to your budget. Pretty much like the default sorting algorithm (lowest price first) in the case of travel/ hotel aggregation platforms. Again, the platforms “learn” based on your expressed preferences.

Expressed preferences to profiling

Now, how do these platforms learn, and what do they learn about your preferences is the black box. Based on a few expressed preferences, these matching algorithms may end up profiling the user, and start providing more and more matches based on that specific profile. Sometimes, these preferences may be specific to a context – like me searching for a business class air ticket (when the client has agreed to pay – I travel economy otherwise!). The algorithm has no way of separating out such preferences without access to a large number and variety of such searches. And such preference-based profiling is easy.

Have you wondered why you get “more relevant” advertisements on a Google search results page than on YouTube? Both owned by the same firm, and possibly can share the matching algorithms. However, the way one could profile search users based on their text inputs and matching them with appropriate websites and advertisements is far easier than in the context of video content. Video content may be devoid of explicit tags that are indexed, may contain sarcasm, the audio and video content may be inadequate, or just non-existent. So, there are days I have been left wondering why I was exhibited a particular advertisement in the beginning of a YouTube video. Sometimes, I conjure up my own hypothesis about what actions in my history, the cookies on my browser/ device (my kids do use my iPad), and what specific search terms triggered those. Black box!

Customization-personalization or privacy: A trade-off

This is no simple trade-off: the one between customization and personalization and privacy. By exposing my preference for a particular sport (like cricket) to YouTube, I get to see a lot of interesting cricket video suggestions, right up front on the home page. By subscribing to specific channels, liking certain content, and commenting on some others, I help YouTube learn more about me. These actions provide enough inputs for the platform to customize the match and personalize suggestions. However, there are limits to when such expressed preferences breach privacy. Like when my phone’s AI assistant suggests a wake-up time for me based on my first appointment of the day, or when my wearable device chides for not walking enough during the day (how many steps can you walk in days like today, when the entire country is under lockdown?).

This is not new; and it could be creepy. Remember the 2012 story about the US retailer Target sending out mailers about baby care to a teenage girl, and the parent discovering it? Neither the local Target store had a clue, nor did the parent. The Target central database was able to predict something as personal as teenage pregnancy! Target realized that they were spooking people, and would randomize the offers, like putting ads for lawn mowers next to diaper coupons. But still, they knew!

Dealing with black boxes

I wish I had a set of recommendations for you! One day, possibly. But today, this is just a personal trade-off. As for me, I wouldn’t mind sharing my location data with my phone as long as it provides me good navigation services. And my food delivery app to know where I am, so that I get choices from hyper-local restaurants. I would go one step further and allow my photos app to have my location access so that I could organize my photos by date and location. But to allow location access to online newspapers, no.

Happy matching.

Stay home, stay safe, stay healthy.

© 2020. Srinivasan R