Last month, I was at the Yale University and was listening to Prof. Nathan Novemsky on different mindsets. Of the various mindsets we discussed, psychological distance (and its impact on communication and marketing) caught my attention. In this blog post, I elaborate the concept of psychological distance, and why it is important in the context of entrepreneurship and multi-sided platform businesses.

Psychological distance: Basics

Prof. Novemsky’s (and his colleagues’) research indicates that as people get closer to the decision in terms of time, their mindset changes from a “far mindset” to a “near mindset”. When people engage with you on a far mindset, they are concerned about the “why” questions; whereas when they engage with you on a near mindset, they are concerned about the “how” questions.

Let me illustrate. When a customer downloads an Uber App for the first time, she is more concerned about how she is contributing to the environment by being part of the shared economy, and therefore is less concerned about issues like the minute features of the user interface/ user experience. On the other hand, a customer who is getting out of a day-long meeting with a demanding customer is worried more about the minute details of the ride, like the time taken for the car to arrive, type and cleanliness of the car, and driver’s credentials and behavior; as she is engaging on a near mindset.

Communication and marketing

The understanding of what mindset your customer is engaging with you is imperative to designing your communication. When you advertise a grocery home delivery service on television, you might want to appeal to the consumer’s far mindset … that talks about why he should choose your service rather than the neighborhood grocer/ vegetable market. For instance, the benefits of fresh produce straight from the farm (without middlemen) faster would make immense sense. However, when you communicate with your customer after he has decided to place an order, you might want to talk about specific discounts, receiving delivery at a convenient time, quantity changes, add-ons and freebies, and payment options.

What does this mean to start-ups/ entrepreneurs?

That’s simple, right. A founder communicating with a potential investor should talk to the “far mindset” rather than the “near mindset” if he has to raise money. However, a customer presentation has to appeal to the near mindset.

For instance, the home-health care start-up for pets (petzz.org) communicates convenience of all-day home-visits of veterinarians to its pet-owners; the specific plans available that pet-owners can choose from; and the significant increase in business for the veterinarian partners. However, when it runs camps to enroll pet-owners, it talks about “healthy pets are happy pets” communicating to the far-mindset.

However, the investor deck only appeals to the far mindset … how their business model leads to “healthy pets” and why this is a compelling value proposition for its pet-owners, veterinarians as well as other partners in its platform.

[Disclaimer: I advise petzz.org]

Implications for multi-sided platforms

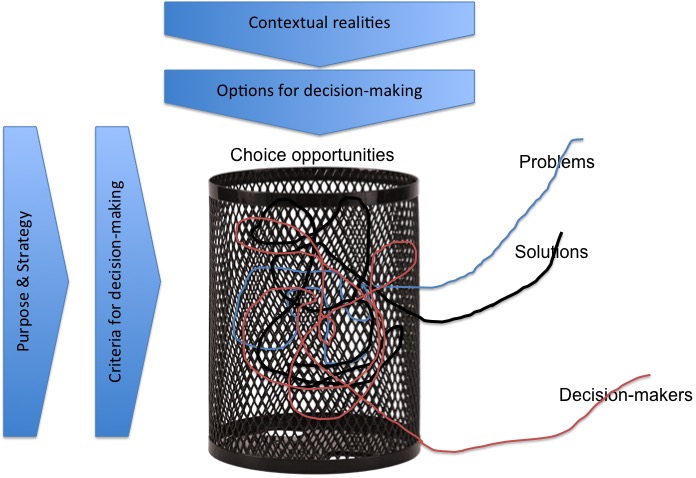

Not so simple. I can envisage that there may different sides of a platform that may be operating at different mindsets and the MSPs may need to be continuously aware of. Take the example of the social-giving/ crowd-funding platform Milaap (milaap.org). The two sides of the platform are givers and fund-raisers.

Imagine a fund-raiser appeal … which one appeals to you most?

- “help a school from rural Chattisgarh build toilets for girls”

- “help support girls’ education”

- “make sure girls like Shanti don’t drop out of school”

As you move down from option 1 to 2 to 3, you are increasingly operating from the far-mindset!

On the other hand, when Milaap attracts fund-raisers with the following messages

- “you get the most socially-conscious givers at milaap”

- “it’s easy to communicate with givers at milaap”

- “it’s is easy to login, set up and free”

As you move down from option 1 to 2 to 3 here, you move towards a near-mindset!

It gets more complicated when the different sides of the platform are at different stages of decision-making. For instance, when a C2C used-goods marketplace platform like Quikr has a lot of buyers and lesser number of sellers; the messaging across the two sides has to be different! For the sellers who are yet contemplating joining the platform, the message has to be appealing to the far mindset (of decluttering their homes), whereas for the umpteen buyers who are looking for goods on the platform, the message has to appeal to the ease of transacting (near mindset).

Match the message to the mindset and the stage of the engagement

In summary, effective platforms have to communicate consistently across multiple sides of the platform, however keeping in mind the different mindsets of the respective sides. A cab hailing app has to communicate differently to its riders as well as drivers, while sustaining the same positioning. If the rider value offering was about speed of the cab reaching you, the driver communication has to be consistent – speed of reaching the rider. For the driver, it is near mindset (speed of reaching the rider is about efficiency), whereas for the rider, speed may be appealing to the far mindset (about not driving your own car and keep it waiting all day at an expensive parking place; or better still, reducing congestion in the city centers). And for sure, these messages also have to change over the various stages of consumer engagement, right!

Any examples of mismatched communication welcome!

Cheers from a rainy day in Nuremberg, Germany.

© 2018. R. Srinivasan